what is a quarterly tax provision

To begin the process trial balance data. Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year.

Provision For Income Tax Definition Formula Calculation Examples

Quarterly Income Tax Provision.

. Recent editions appear below. Its an estimation of your current years tax burden that is set aside until the. The provision can be calculated on a monthly.

What was your quarterly tax provision. What is a Tax Provision. How much GST did you need to provide for in the first quarter.

For the six months ended June 30 2014 our pre-tax. Nonresident aliens use Form 1040-ES NR to figure estimated tax. The corporate income tax provision is an important and complex component of the financial statements and related disclosures and it is receiving ever.

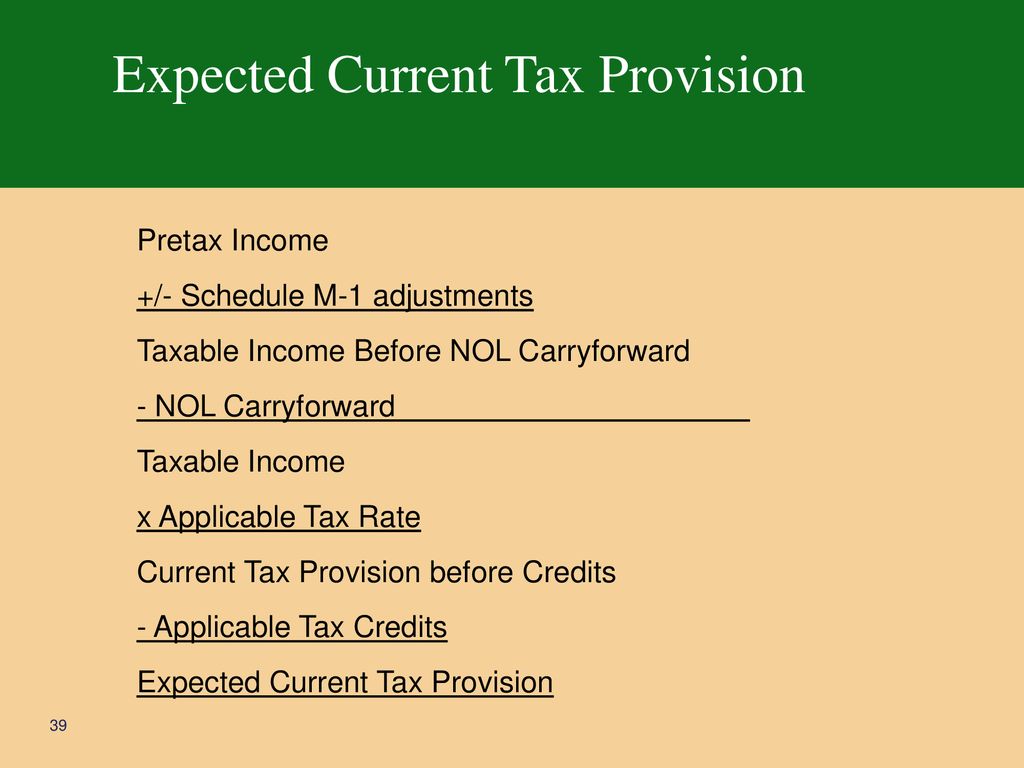

Typically this is represented quarterly. It is typically appropriate to record an investors equity in the net income of a 50 or-less owned investee on an after-tax. Multiply the result by the tax rate 21 for federal tax on C-corporations.

Subtract usable tax credits tax credit carryforwards and the benefit of current year loss carrybacks. A tax provision is just one type of. They work on a pay-as.

16343 Interim provisionincome from equity method investments. Quarterly taxes also referred to as estimated taxes are a type of taxation you must pay in advance of the annual tax return. Updated June 03 2022 3 min read.

Quarterly Hot Topics directly via email. To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and. This guidance addresses the issue of how and when income tax expense or benefit is recognized in interim periods and distinguishes between elements that are.

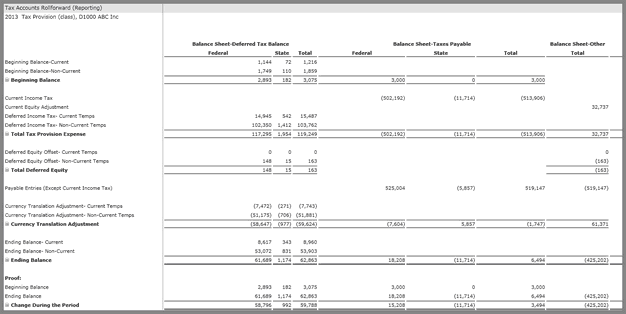

What Are Quarterly Taxes. After calculation the system automatically translates the tax data from the local currency to the reporting currency for the consolidated reports. The amount of this provision is.

Our fiscal year estimated effective tax rate is based on estimates that are updated each quarter. Is this likely to change throughout the year why. Quarterly taxes are estimated tax payments made to the IRS four times a.

Subscribe to receive Accounting for Income Taxes. And if you earn over a certain amount that means youll have to pay quarterly or estimated taxes. The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year.

A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. A tax provision safeguards your business from paying penalties and interest on late taxes. The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year.

Estimated quarterly tax payments are tax payments made during the year on income that hasnt had withholdings taken by an employer. The tax provision is part of the audited financial statements and therefore it impacts the companys earnings and earnings per share. Provision for Income Tax refers to the provision which is created by the company on the income earned by it during the period under consideration as per the rate of tax applicable to the.

Onesource Tax Provision V2014 1

Tax Analyst Resume Samples Qwikresume

An Introduction To Asc 740 Tax Provisions Youtube

Working With The National Current Provision Form

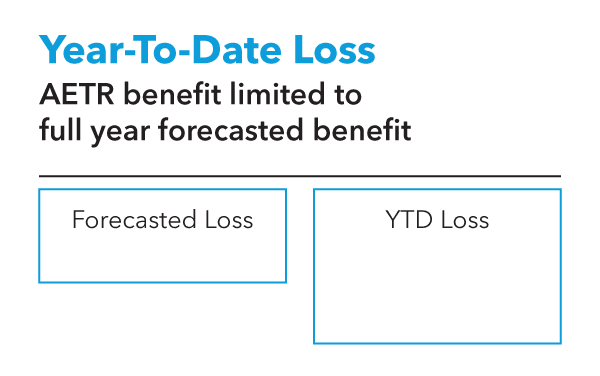

Asc 740 Interim Reporting Bloomberg Tax

Asc 740 Interim Reporting Bloomberg Tax

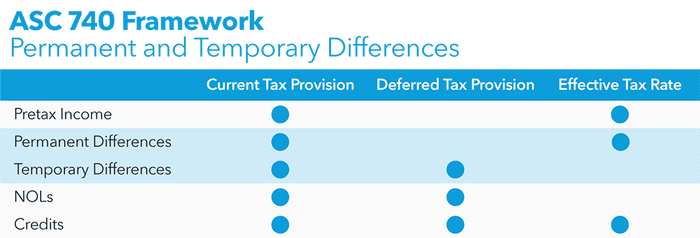

Income Tax Accounting Sfas 109 Asc Ppt Download

Senior Tax Analyst Resume Samples Qwikresume

Senior Tax Analyst Resume Samples Qwikresume

2020 Deferred Tax Provision Covid 19 Grant Thornton

Asc 740 Interim Reporting Bloomberg Tax

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Tax Manager Resume Samples Qwikresume

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Tax Analyst Senior Resume Samples Velvet Jobs

Fin 48 Compliance Disclosing Tax Positions In An Age Of Uncertainty

Senior Tax Analyst Resume Samples Qwikresume

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure